A Legacy Financial System refers to the traditional, long-established structure through which money is stored, moved, managed, and regulated. These systems include conventional banks, central banks, credit unions, insurance companies, payment processors, clearing houses, stock exchanges, and the regulatory frameworks that govern them. They have existed for decades—some for centuries—and form the backbone of modern economic activity.

Although reliable and deeply rooted, legacy systems face increasing pressure from digital transformation, evolving customer expectations, and innovative technologies such as blockchain, digital wallets, and decentralized finance. To understand the future of money, it is essential to examine how these traditional systems developed, how they operate today, and where they struggle to adapt.

The Foundation of Legacy Financial Systems

Legacy financial systems were created in a world where physical infrastructure was essential. Banks required physical offices, paper records, vaults, and manual staff to process transactions. These systems evolved slowly, shaped by strict regulations designed to prevent fraud, maintain stability, and protect depositors. The core principles of legacy finance include:

Stability

Conventional institutions emphasize safety and predictable operation, often sacrificing speed and innovation to maintain reliability.

Centralization

Most processes depend on central authorities. Banks maintain ledgers, governments issue currencies, and regulators enforce rules. This central control ensures oversight but also creates limitations.

Trust

The entire structure depends on people believing that banks will store their money securely, payments will clear correctly, and financial institutions will follow established rules.

Over time, these systems expanded globally and became interconnected, enabling international trade, corporate finance, and the economic development of nations.

2. Key Components of Legacy Financial Systems

A legacy financial system is made up of many interconnected parts, each serving a unique purpose.

Commercial Banks

These institutions provide checking and savings accounts, loans, mortgages, and payment services. They remain the most visible part of the financial system.

Central Banks

Central banks regulate monetary policy, manage national interest rates, issue currency, and supervise financial stability. They act as lenders of last resort during crises.

Payment Networks

Traditional payment channels include wire transfers, credit card processors, ACH systems, and SWIFT for international transactions. Many of these systems are slow and operate only during business hours.

Clearing Houses

Clearing houses settle transactions between institutions, reducing risk and ensuring that money actually moves as intended.

Regulatory Bodies

Financial regulators establish the rules that govern lending, investment, capital reserves, consumer protection, and market fairness.

Together, these entities form a highly structured—but often rigid—system that has served the global economy for generations.

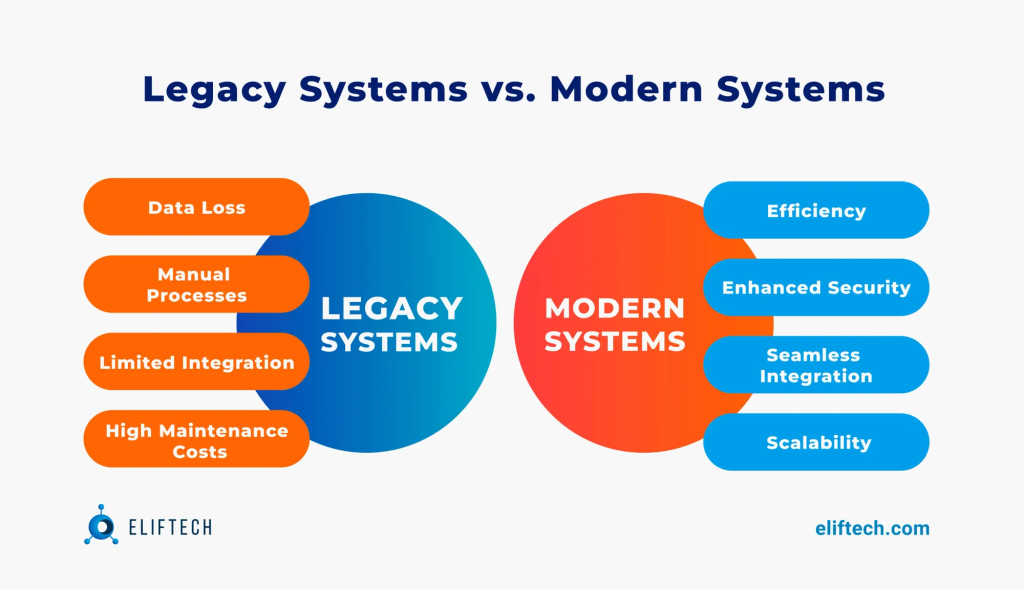

3. Advantages of the Legacy Financial System

Despite their limitations, legacy systems remain essential for several reasons.

1. High Level of Security

Years of regulatory development, auditing, and oversight ensure that consumer funds are protected. Fraud detection systems and compliance standards add layers of safety.

2. Trust and Reputation

Banks and financial institutions have long histories. This familiarity builds confidence among consumers and businesses.

3. Regulatory Protection

Consumers benefit from deposit insurance, lending regulations, dispute resolution processes, and established legal frameworks.

4. Global Acceptance

Traditional finance is fully integrated into global commerce. Businesses around the world rely on established systems for trade, investment, and currency exchange.

5. Large-Scale Infrastructure

Legacy institutions maintain vast networks of branches, ATMs, and service centers that provide physical access and personal support.

For many people and industries, these advantages make legacy finance indispensable.

4. Limitations and Challenges of Legacy Financial Systems

While strong in stability, legacy systems face major structural problems that limit their ability to adapt.

1. Slow Transaction Speeds

Traditional wire transfers and cross-border payments can take hours or even days due to multiple intermediaries, clearing processes, and business-hour restrictions.

2. High Operational Costs

Maintaining physical branches, manual staff, and old technology systems increases expenses that are often passed on to customers.

3. Limited Access

Billions of people worldwide remain unbanked or underbanked due to lack of documentation, geographic barriers, or high fees. Legacy systems struggle to reach these populations.

4. Outdated Technology

Many institutions still rely on decades-old software written in outdated programming languages. Upgrading these systems is costly and risky, leading many banks to delay modernization.

5. Centralized Control

Centralization concentrates power in the hands of a few institutions. This can lead to bottlenecks, system failures, or crisis contagion during periods of instability.

These weaknesses have created an environment where new technologies can challenge traditional finance and offer faster, cheaper, and more accessible alternatives.

5. The Rise of Modern Alternatives

Several innovations are pressuring legacy systems to evolve. These include:

Digital Banking

Fintech banks and neobanks operate entirely online, offering quick account creation, low fees, and user-friendly apps. They reduce overhead and attract younger, tech-savvy customers.

Blockchain and Cryptocurrency

Blockchain-based networks allow peer-to-peer transactions without intermediaries. They offer faster settlement, transparency, and global access.

Decentralized Finance (DeFi)

DeFi platforms enable lending, borrowing, and investing without traditional banks, using smart contracts instead of human intermediaries.

Mobile Wallets

Digital payment apps simplify everyday transactions and dominate in countries where traditional banking is costly or inefficient.

These innovations challenge legacy systems to modernize or risk falling behind.

6. How Legacy Systems Are Adapting

Rather than being replaced outright, many traditional institutions are combining their stability with modern technology.

Investment in Digital Transformation

Banks are upgrading software, implementing cloud solutions, and developing mobile platforms to improve customer experiences.

Partnerships with Fintech Companies

Collaboration allows traditional banks to adopt new tools quickly without completely rebuilding their internal systems.

Regulatory Sandboxes

Governments allow controlled experimentation with new financial technologies, helping legacy systems adapt without compromising stability.

Instant Payment Systems

Some countries have adopted faster payment infrastructures that drastically reduce transaction times.

These strategies show that legacy systems are not disappearing—they are evolving.

7. The Future of the Legacy Financial System

The future will likely be a hybrid environment where legacy institutions remain important but operate alongside digital-first alternatives. We can expect:

- Faster, near-real-time payments

- Improved cybersecurity

- More automation in banking processes

- Greater inclusion of unbanked populations

- Integration of blockchain into settlement systems

- Declining use of physical branches

Legacy systems will remain central, but they must continue transforming to meet global expectations for speed, accessibility, and transparency.

Conclusion

The Legacy Financial System has shaped the global economy for generations. Built on stability, regulation, and trust, it remains essential for governments, businesses, and everyday consumers. However, its structural limitations—slow transactions, high costs, and outdated technology—have created opportunities for digital innovations to emerge.

Rather than being replaced, legacy systems are entering a new era of transformation. By embracing modern technology and adapting to customer demands, they can continue to play a vital role in the future of global finance. The evolution of money will not be a battle between old and new but a collaboration that blends tradition with innovation, ultimately creating a more efficient, accessible, and resilient financial world.