In today’s fast-paced global economy, understanding market trends is crucial for businesses, investors, and consumers alike. Market trends refer to the general direction in which a market is moving, whether upward, downward, or sideways, over a period. Observing these trends helps businesses make informed decisions, anticipate changes, and gain a competitive advantage. In this article, we will explore the key aspects of market trends, their importance, and how to analyze them effectively, while incorporating the keyword “yr” as a point of reference.

What Are Market Trends?

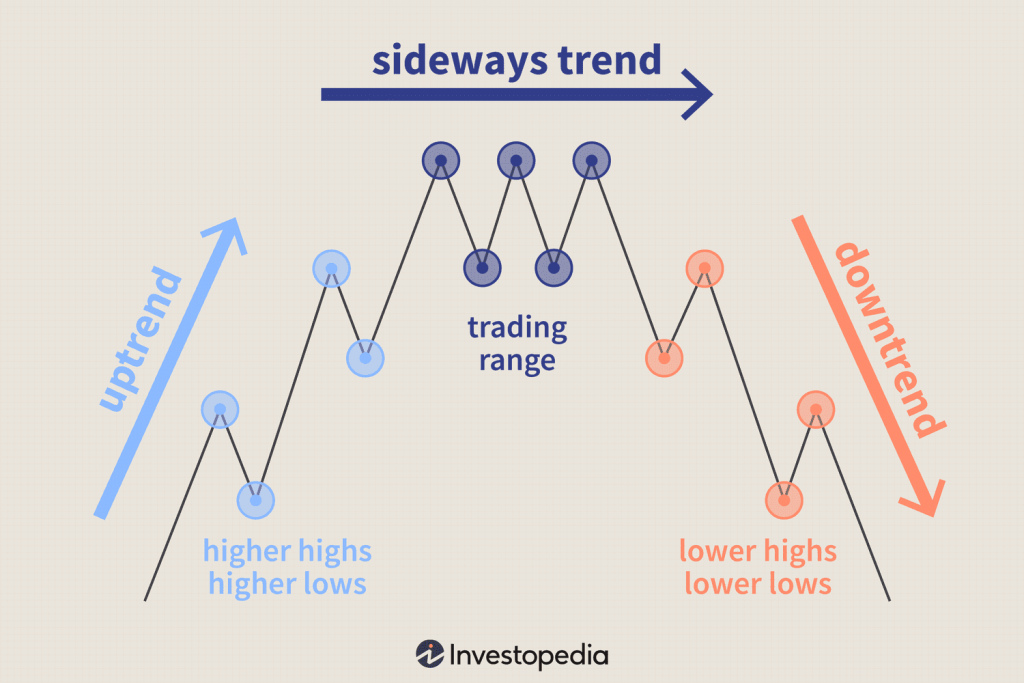

Market trends are patterns or tendencies observed in a specific market over a period. They can be influenced by economic conditions, consumer behavior, technological advancements, and political events. Generally, market trends are classified into three types:

- Uptrend: An uptrend occurs when prices or demand in the market consistently rise over time. This indicates optimism and growth in a particular sector. For example, the renewable energy market has been in an uptrend for the past few yr due to increasing global awareness about climate change.

- Downtrend: A downtrend is the opposite, where prices or demand decline over time. Downtrends can result from economic slowdowns, market saturation, or changes in consumer preferences. A decline in traditional retail sales over the last few yr illustrates a clear downtrend in that sector.

- Sideways Trend: Also known as consolidation, a sideways trend occurs when prices or market activities remain stable without significant increase or decrease. Markets often enter this phase before a major move, either upward or downward. The stock market, for instance, may show sideways trends in certain sectors yr after yr during periods of uncertainty.

Importance of Market Trends

Monitoring market trends is vital for several reasons:

- Strategic Planning: Businesses can adjust their strategies based on current trends. For instance, a company observing an uptrend in e-commerce sales might increase its investment in online marketing channels. Yr-to-yr analysis helps in identifying which strategies are effective and which need adjustment.

- Investment Decisions: Investors rely heavily on market trends to make informed choices. Understanding whether a sector is in an uptrend or downtrend allows investors to allocate resources wisely. Tracking trends yr after yr ensures long-term investment growth.

- Consumer Insights: Companies can better understand consumer preferences by analyzing market trends. For example, the increasing trend toward sustainable products over the past few yr indicates that consumers are more environmentally conscious, influencing businesses to adapt their offerings.

- Risk Management: Recognizing shifts in trends helps organizations mitigate risks. Businesses that notice a downtrend early can pivot their operations or diversify their portfolio, reducing potential losses. Yr-based data analysis is particularly useful in forecasting potential downturns.

Factors Influencing Market Trends

Several factors contribute to shaping market trends. Understanding these factors helps in predicting future movements:

- Economic Indicators: Elements like GDP growth, inflation rates, and employment levels play a crucial role in determining market behavior. A strong economy usually correlates with an uptrend in consumer spending and investment.

- Technological Advancements: Technology can disrupt markets, creating new trends or altering existing ones. The rise of artificial intelligence and automation over the past few yr has significantly impacted various industries, driving new market trends.

- Consumer Behavior: Shifts in consumer preferences directly influence market trends. Social trends, lifestyle changes, and generational differences contribute to the rise or fall of specific products and services.

- Political and Regulatory Environment: Government policies, trade regulations, and political stability can affect market movements. For instance, changes in tax policies or import-export regulations may lead to noticeable trends within affected industries.

- Global Events: Events like pandemics, wars, or natural disasters can have a profound impact on markets. The COVID-19 pandemic, for instance, caused a sudden shift in market trends, with increased demand for digital services and healthcare products over the last yr.

How to Analyze Market Trends

Analyzing market trends requires a combination of qualitative and quantitative methods. Some key approaches include:

- Historical Data Analysis: Examining past market data provides insights into potential future trends. Yr-on-yr comparison of sales, stock prices, or consumer demand helps identify recurring patterns.

- Market Research: Surveys, focus groups, and interviews provide qualitative insights into consumer preferences and behavior. Understanding why trends occur is as important as knowing that they exist.

- Technical Analysis: Commonly used in financial markets, technical analysis involves studying price charts, patterns, and indicators to predict future market movements. This method is often applied by investors who track trends yr after yr.

- Competitor Analysis: Monitoring competitors’ strategies and performance can reveal emerging trends. Businesses can identify opportunities and threats by observing how competitors adapt to market shifts.

- Trend Forecasting: Using statistical models and predictive analytics, companies can forecast future trends. While predictions are not always 100% accurate, they provide valuable guidance for decision-making.

Examples of Current Market Trends

Several significant trends are shaping modern markets today:

- Sustainability: Consumers increasingly prefer environmentally friendly products, pushing companies to adopt sustainable practices. Over the past few yr, this trend has influenced industries ranging from fashion to energy.

- Digital Transformation: Businesses are embracing digital tools and platforms to enhance efficiency and customer engagement. The adoption of cloud computing, e-commerce, and digital marketing has accelerated yr after yr.

- Health and Wellness: Growing awareness of personal health has boosted demand for fitness products, organic foods, and wellness services. The market for health-related products has expanded consistently over the last few yr.

- Remote Work and Flexibility: The rise of remote work has created demand for collaboration tools, home office equipment, and flexible services. This trend continues to evolve yr on yr as organizations adapt to changing work environments.

- Artificial Intelligence and Automation: AI and automation are transforming industries, creating new opportunities and challenges. Over the last few yr, the adoption of AI-driven solutions has become a key driver of market growth.

Conclusion

Market trends are powerful indicators of the direction in which industries, investments, and consumer behavior are moving. Recognizing and analyzing these trends allows businesses and individuals to make informed decisions, reduce risks, and seize opportunities. Yr-to-yr observation of market behavior provides deeper insights into recurring patterns, helping strategists anticipate changes before they occur.

Understanding the dynamics of market trends is no longer optional—it is a necessity in today’s competitive and interconnected global economy. By staying informed, analyzing data, and responding proactively, businesses and investors can navigate the complexities of modern markets and achieve sustainable growth.