Day trading is a popular strategy in the financial markets where traders buy and sell financial instruments within the same trading day. Unlike long-term investing, day trading focuses on short-term price movements and market fluctuations. Traders aim to take advantage of small price changes and often make multiple trades in a single day. This strategy can be lucrative, but it also carries a high level of risk and requires a deep understanding of the markets, discipline, and a clear strategy.

Understanding Day Trading

Day trading can involve a variety of financial instruments, including stocks, forex, options, and futures. The main principle is to capitalize on short-term price movements. Day traders do not hold positions overnight, which reduces exposure to after-hours market risks such as sudden news events or earnings reports.

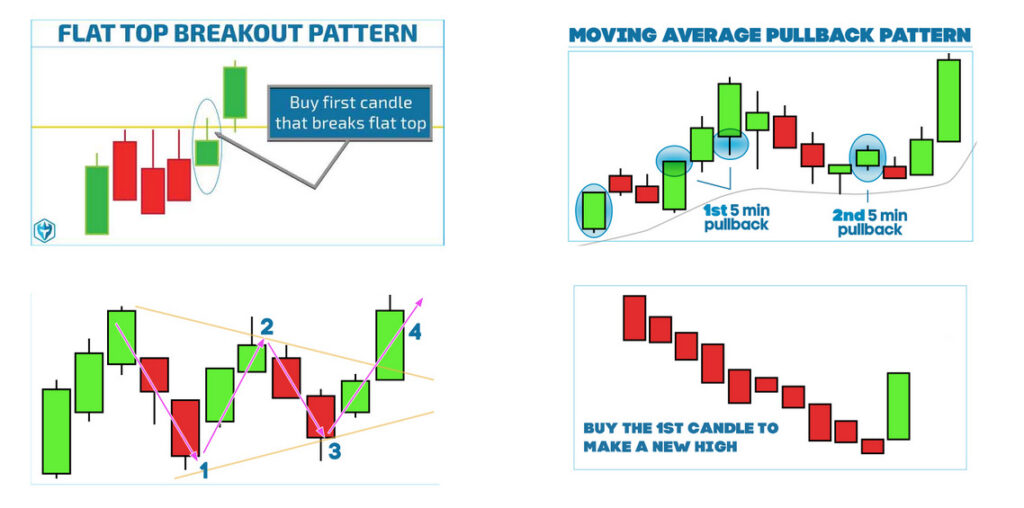

Traders use technical analysis, charts, and patterns to make informed decisions. Some common strategies include momentum trading, scalping, and swing trading. Momentum traders focus on stocks moving strongly in one direction, scalpers aim for very small profits through rapid trades, and swing traders attempt to capture short-term price trends over a few days.

Key Tools and Techniques

Successful day trading requires the right tools and techniques. Some essential tools include:

- Trading Platform: A reliable platform allows traders to execute trades quickly and monitor real-time market data. Speed and accuracy are crucial because prices can change in milliseconds.

- Charts and Indicators: Technical charts, moving averages, Relative Strength Index (RSI), Bollinger Bands, and other indicators help traders predict price movements and make better decisions.

- News and Market Data: Staying updated with financial news, earnings reports, and economic indicators is important because these factors can significantly impact prices.

- Risk Management Tools: Stop-loss orders, position sizing, and risk-reward ratios help protect traders from large losses.

Essential Skills for Day Traders

Day trading is not suitable for everyone. It requires a specific skill set, including:

- Discipline: Traders must stick to their strategy and avoid emotional decisions.

- Patience: Waiting for the right opportunities is essential. Impulsive trades often lead to losses.

- Analytical Thinking: Understanding market patterns, technical indicators, and price movements is crucial for making informed decisions.

- Adaptability: Markets are constantly changing. Successful traders adapt quickly to new trends and conditions.

Risks in Day Trading

While day trading offers potential profits, it also comes with significant risks. Short-term price movements can be unpredictable, and traders can experience large losses if not careful. High leverage, common in day trading, can amplify both gains and losses. Market volatility, sudden news, or technical errors can also negatively impact trades.

Due to these risks, day trading requires a strong risk management strategy. Traders often risk only a small percentage of their capital on each trade and set strict limits to prevent catastrophic losses.

Psychological Aspects

The psychological aspect of day trading is often overlooked but is equally important. Emotional control, stress management, and confidence are critical. Fear and greed can drive irrational decisions, leading to losses. Successful day traders develop a mindset that balances discipline, patience, and rational decision-making.

Steps to Start Day Trading

- Education: Understanding market basics, technical analysis, and trading strategies is the first step.

- Choosing a Market: Decide whether to trade stocks, forex, options, or futures based on your expertise and risk tolerance.

- Developing a Strategy: Test strategies using historical data or paper trading before investing real money.

- Selecting a Broker: Choose a broker with low fees, reliable platforms, and fast execution.

- Starting Small: Begin with a small capital and gradually increase as experience grows.

- Continuous Learning: The market evolves constantly, so ongoing learning and strategy refinement are essential.

Advantages of Day Trading

- Potential for High Profits: With the right strategy, day traders can earn significant returns in a short period.

- Independence: Day trading offers flexibility and allows traders to work independently.

- Skill Development: Traders develop analytical and decision-making skills, which can be applied to other financial activities.

- No Overnight Risk: By closing positions at the end of the day, traders reduce exposure to unexpected news or events outside market hours.

Challenges of Day Trading

- High Risk: Losses can be substantial, especially for inexperienced traders.

- Time-Consuming: Day trading requires constant monitoring of markets and quick decision-making.

- Emotional Stress: Rapid market movements can lead to stress and emotional trading.

- Costs and Fees: Frequent trading can result in high transaction costs, which can reduce overall profitability.

Conclusion

Day trading is a dynamic and challenging approach to financial markets. While it offers the potential for significant profits, it also demands skill, discipline, and risk management. Understanding market trends, using the right tools, and maintaining emotional control are key to success. Beginners should start with education and practice, gradually building experience and confidence. With dedication and the right strategy, day trading can become a rewarding activity, offering financial opportunities and personal growth.